Debt structure

Signify’s debt consists of Bonds, Schuldschein and Term Loans in EUR.

Signify also has a EUR 600 million committed multi-currency revolving credit facility (RCF), signed in October 2025. The RCF has a maturity of five years (October 2030), with the option to extend it twice by one year at the end of the first and second anniversary. To date, Signify’s revolving credit facility has remained undrawn.

The Schuldschein, Term Loans and RCF agreements include a financial covenant providing that Signify maintains a net leverage ratio of no greater than 3.5x. The net leverage ratio may temporarily increase to 4.0x within 12 months of the closing of material acquisitions. The covenant does not apply if the company has at least one investment grade rating, which is currently the case (link to credit rating).

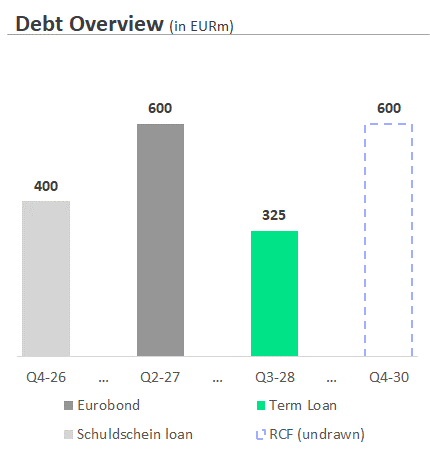

Signify’s debt profile per October, 2025, consists of EUR 600 million in Bonds, EUR 400 million in Schuldschein loan and EUR 325 million in Term Loans: